The following article is adapted from a talk developed for the “Adoption of AI in Construction” panel hosted by Parspec at WeWork for San Francisco Tech Week on 10/8/24.

Mayra Soto at the AI Adoption in Construction panel hosted by Parspec at WeWork for San Francisco Tech Week 2024.

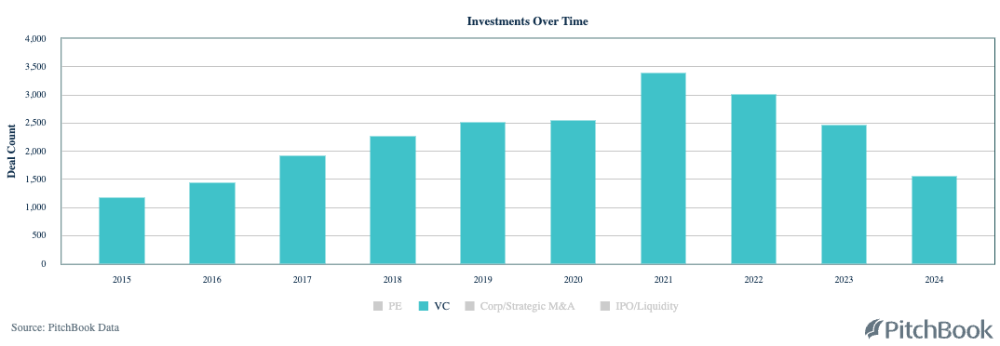

Artificial Intelligence, or AI, is not new. But only recently has this technology experienced a significant surge in mainstream adoption, particularly following the release of ChatGPT in November 2022. Before AI went mainstream, the venture industry witnessed momentum building. We saw a peak in investments in the AI and Machine Learning (ML) space in 2021, with over 3,500 deals totaling $87 billion. Notable companies like Waymo, Databricks, and Airtable secured substantial funding raising $2.5 billion, $2.6 billion, and $735 million, respectively.

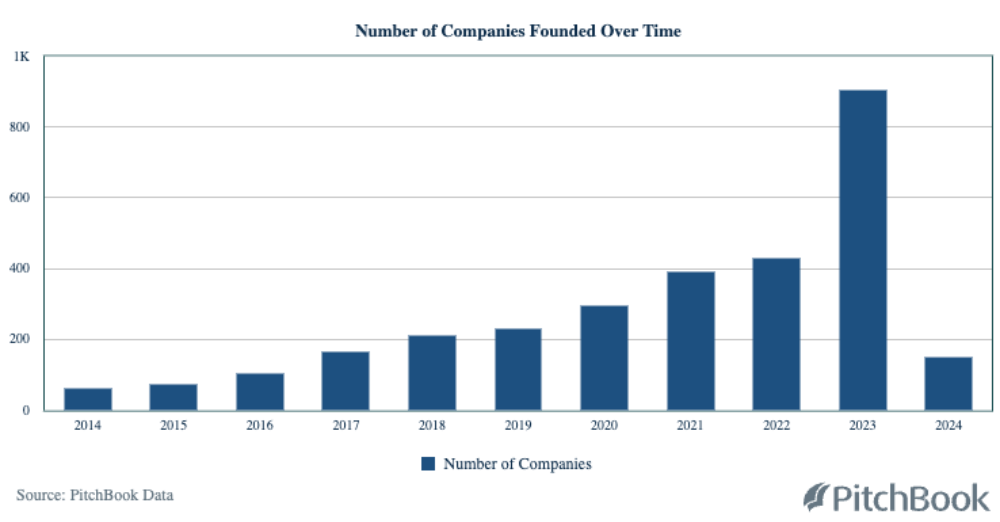

Furthermore, generative AI has emerged as a rapidly growing space with around 900 startups founded in 2023 alone. This data, gathered by Pitchbook, may not include ventures at the pre-seed or stealth stage. Companies building the foundational models are allocating more resources to make them better, and there is a huge capital going into these types of companies. For example, OpenAI just raised $6.6 billion, making it the largest venture round. As investors and due to the improvements in foundational models, we can only assume that there will be a proliferation of usage of this technology both in internal tasks and new startups.

The construction industry is not immune to these trends. At Building Ventures, we track thousands of startups. As part of this tracking, we classify companies based on the problem they are trying to solve but also which technologies they leverage in order to solve the problem.

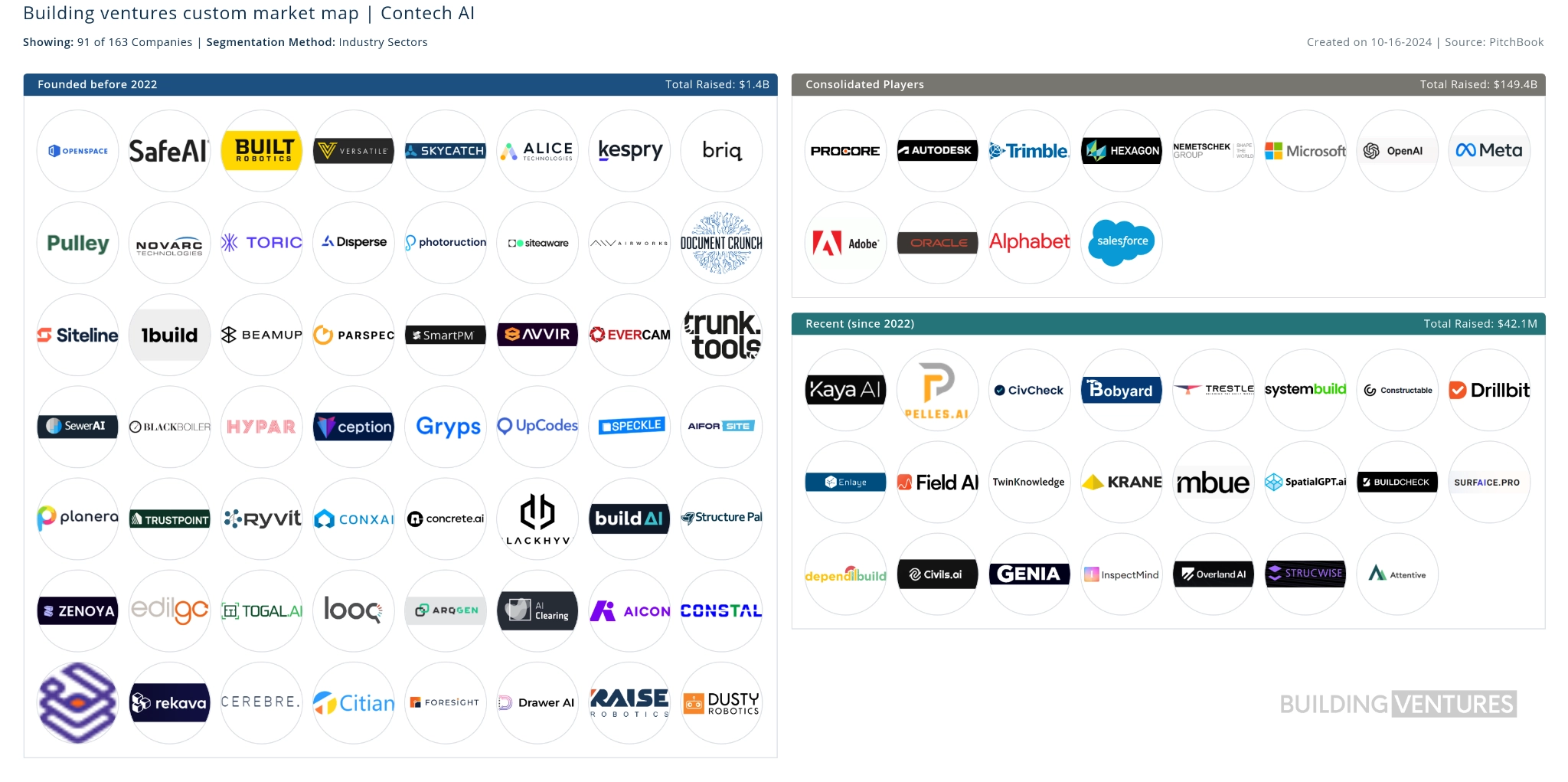

The following market map represents how we see the current contech space when it comes to AI. The logos here are trying to transmit an idea more than being representative of the total number of startups we see in the space. For purposes of our view of the market, we have broken down the solutions into three buckets: startups founded before 2022, consolidated players, and companies founded since 2022.

The first bucket are solutions founded prior to the release of chatgpt in 2022, which were either already leveraging AI as part of their offering or that have implemented this technology. Implementing artificial intelligence can be done as part of their internal operations or as customer facing functionality.

Then we have consolidated players. Here, we include construction platforms targeting many workflows in the contech space or horizontal players. This set of enterprises have the advantage of access to large data sets that have been aggregated by their clients over the years. In this case, they can already leverage existing foundational models in order to provide custom functionality based on their vertical or in case of players like Microsoft enable customers to build their own custom solutions using tools like Copilot.

This is a very interesting bucket, because as investors when we see a new solution in the market we evaluate if this is a functionality that can be provided by one of these players or if due to the available tools can be built in house by the contech companies.

Our third bucket is the recent solutions that have been founded post ChatGPT release in 2022, and are leveraging AI technology from the get-go. While we are bullish about technology, at Building Ventures, we focus on founders with a unique understanding of a problem they aim to solve instead of technology first teams. This principle applies when evaluating solutions in this bucket.

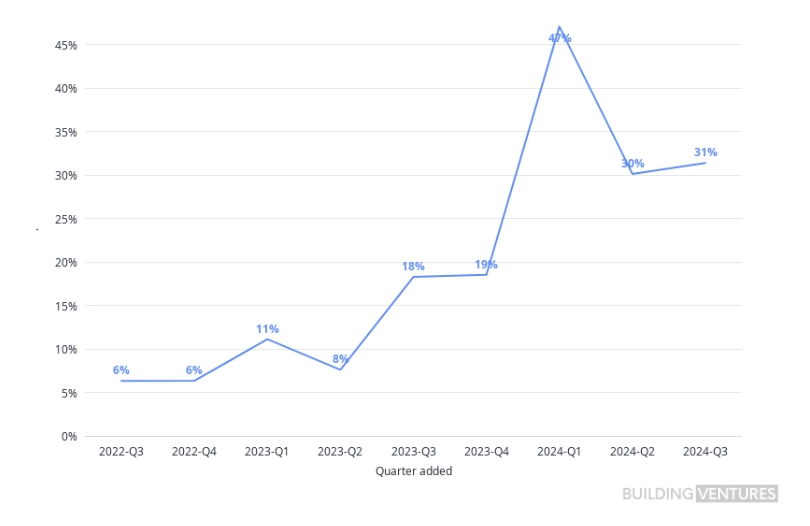

In line with my previous statement, the contech space is not immune to broader trends, and we have seen a sizable increase of solutions leveraging AI in their customer offering. In just Q1 of this year, 47% of the opportunities that we logged in our CRM used AI.

At this stage, and as foundational models become more powerful, we believe leveraging AI technology in order to provide value to customers is no longer a differentiator. It is simply table stakes. This mirrors the initial adoption of mobile and cloud technologies in the contech space. While once considered groundbreaking, they rapidly evolved into industry standards.

The release of ChatGPT has marked an inflection point in the tech world, but also in the mainstream adoptions of AI. While the future of AI remains uncertain, it is clear that this technology has the potential to revolutionize a wide range of industries and create significant economic value. We are hopeful that its impact in the construction industry will be positive and we look forward to seeing the evolution of these trends in order to transform the built environment and by default make it a better built world.