When we started Building Ventures in 2018 with our $53 million debut fund, Travis and I had a clear mission in mind: to invest in early-stage startups working to create a better built world. We knew that the area needed focus, innovation, and capital in order to improve our physical spaces to meet the needs of our growing population and combat the significant impact buildings have on our climate. Over the last four years, we’ve seen massive growth in investments in and increasing adoption of construction and prop tech along with the rise of climate tech. But there’s still work to do.

We’re excited to announce today that we’ve closed our second fund with $95 million in fresh capital dedicated to supporting innovation in the built environment.

Investing in a better built world

While the industry has become increasingly hungry for innovation, spurring the creation of new firms focused on contech, proptech, and climate solutions, buildings still pose what our team calls “the 40% Problem.” The processes of constructing, operating, and maintaining buildings significantly contribute to our landfill waste, raw material consumption, energy use, and emissions. To us, that’s a call to action—and a significant opportunity.

Considering the built environment as a connected system is essential for progress. With our second fund, we will continue to invest in exceptional entrepreneurs leveraging technology throughout the full building lifecycle to bring innovation to the design, build, operate, and experience phases.

Mentoring early-stage startups

Our team represents experienced investors, entrepreneurs, and startup operators. We know firsthand how difficult it is to launch and scale a startup, and that’s why our entire team is committed to post-investment support. Our model of mentoring early-stage entrepreneurs remains central to our investment approach, as it’s been since our earliest investments from our first fund.

“Building Ventures was the first investor who committed to Dandelion—before any other investors had said yes, before we had the market traction or the press we now have,” said Kathy Hannun, founder of Dandelion Energy, the nation’s largest geothermal company and one of BV’s earliest investments. After investing in Dandelion’s seed round in 2017, we followed on with participation in the Series A in 2020 and the Series B last year. Dandelion and Kathy reflect the long-standing relationships we have with both our portfolio companies and the founders we back. Our timing and approach is what we call “sapling stage”: we like to invest when a company is still early enough in its formative development that our team’s experience, expertise, and network can help it to attract the best talent and optimal early customers to help it grow and reach its potential. This also means we’re not limited by the typical conventions of Seed or Series A investments.

Connecting the industry

As our “saplings” mature, we also pursue opportunities to connect with larger institutions across the building lifecycle. We assembled a select group of industry leaders who share our commitment to championing a better built world with the launch of the Building Ventures Innovators Network, or BVIN, in 2018.

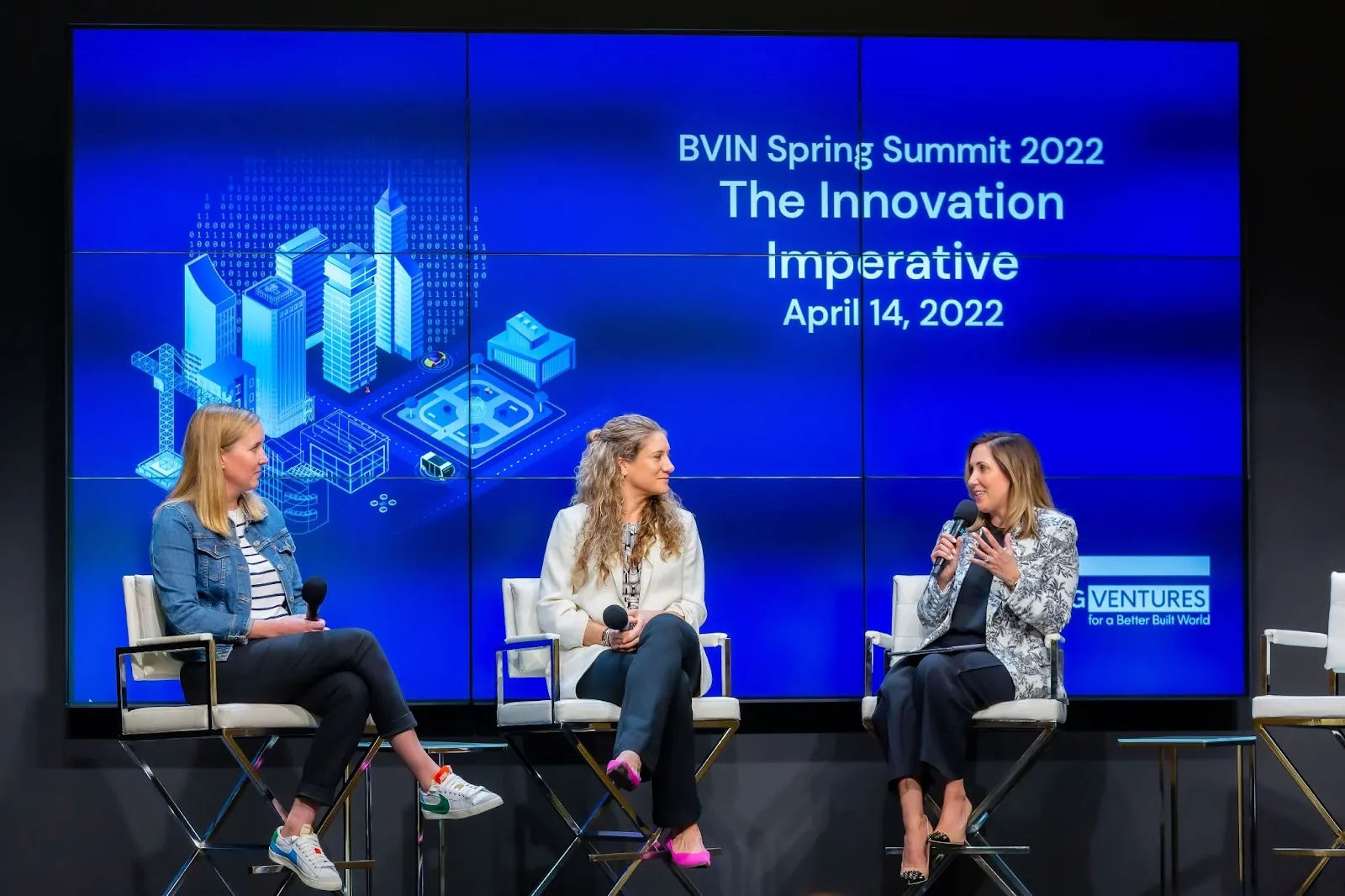

BVIN members include leaders at the largest developer, owner, and manager of office properties in the United States; at the largest global real estate management firm; built environment sustainability officers at software firms; professors of architecture at institutions like Yale and Stanford; and more professionals across AEC and real estate committed to working together to share solutions to the large-scale challenges our industry faces. Our BVIN Spring Summit in April included sessions on the industrialization of construction, designing and building for mission critical structures, and the state of net-zero concrete. We’re hosting the BVIN Fall Summit in Boston next month, where we’ll explore the impact of artificial intelligence and machine learning on designing sustainable offices, the use of IoT in the most data-forward development in the Boston area for life sciences, and more.

From left to right, Lindsey Rem of Barton Malow, Rose Hall of AXA XL, and our own Heather Widman at our most recent BVIN Summit.

Our investors are the same people who are actively searching for improvements and solutions. More than two-thirds of Building Ventures’ capital under management comes from strategic partners who are leading global general contracting firms, innovative builders, and design firms. Our strategic LP relationships as well as our BVIN community offer our team valuable insight into the near- and long-term priorities of the industry. As a result, we’re able to provide our portfolio companies with this information as well as the unparalleled industry connections.

Launching Building Ventures Fund II

We invested in 16 companies from Fund I. With Fund II, we plan to invest in 18-20 additional companies to further our mission to create a better built world. We’ve already deployed capital to five exceptional teams, including two yet-to–be-announced companies and:

- Animated Insights, a leading provider of digital twin technology solutions across industry and infrastructure.

- Extracker, commercial construction’s only change order communication platform.

- Skillit, a powerful recruiting platform that provides construction companies access to a growing network of qualified workers.

In order to continue supporting our portfolio companies, championing innovation across the built environment, and monitoring the larger proptech and contech investment landscape, we’re enhancing our team. Heather Widman, who has been with Building Ventures since early 2019, has been promoted to partner.

If you’re working to reshape the way we design, build, operate, or experience our built environment, or you know a driven founder who is, we want to hear from you.

And if you believe in our mission, keep in touch as we keep working #ForABetterBuiltWorld.